'Working poor' struggling as costs rise, budgeting service says

Wearing secondhand clothes, making food last longer and free activities for the children are some of the ways people in East Auckland suburb Glen Innes are coping with the cost-of-living crunch.

Confirmation today that the Official Cash Rate is holding steady at 5.5 percent will provide some relief for home owners, although it may only offer a plateau for mortgage interest rates.

Elsewhere costs are rising too, such as at the petrol pump and at the supermarket.

Ashleigh Greyling and her family own their home home and are feeling the effects of mortgage rate increases.

"I think, like everyone, it's got quite a huge impact, obviously with the mortgage going up and the cost of living in general going up," Greyling said.

"We both work in our household and even that makes it tough, so we've got to cut back on lots of things just to be able to cover costs."

Those cuts included activities to keep their two children entertained, she said.

"[We've cut] any sort of luxuries, eating out, takeaways, treats for the kids, doing activities, just general things like even going to the zoo or aquarium.

"Things like that don't happen any more. It's all got to be free activities, so going for a walk to the beach, something that doesn't cost us anything."

The family planned lunches and watched spending at the supermarket, Greyling said.

"We're definitely feeling it a lot more than we were three years ago. I've always worked part-time, but now I'm feeling the pressure to work extra hours and longer days just to try and make ends meet."

It was not just mortgage holders struggling with cost of living pressures, as inflation hovers around 7 percent.

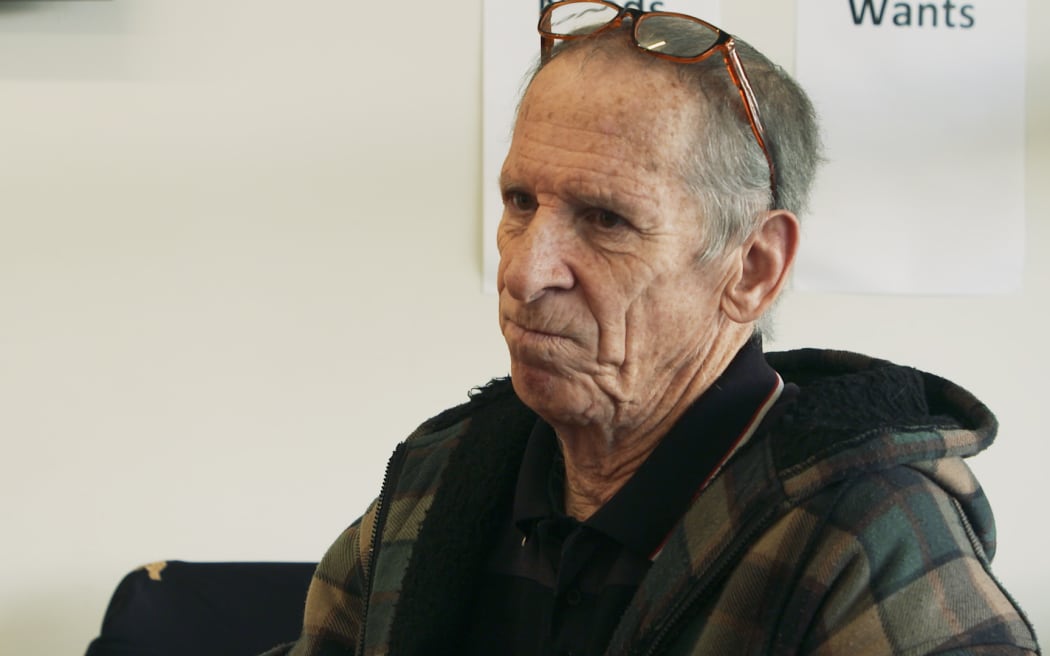

Pensioner Donald O'Meara and his wife watched every penny.

"We're finding it very hard," he said. "We're cutting back on certain items that we can't afford to buy any more and trying to make things stretch, like doing meals that can go two meals instead of one.

"With a bit of chicken or something, we try and make that so we can have sandwiches the following day.

"[We're also] cutting back on food and not having the heater on, and things like that."

The squeeze was affecting their quality of life, he said.

"We can't go out and do little things we used to enjoy, like even going down to the beach, because it's a cost we don't really want to incur.

"It's an enjoyment we used to have, being able to go down there and sit at the beach and have fish and chips, or something like that, that we can't afford to do any more."

Even when the pension went up, O'Meara's public housing rent increased too, and over the past six or seven months the financial pressure had grown worse.

"It might be an oddball thing, but I'm wearing secondhand clothes all the time too because I'm having to go to the op shops because I can't afford to buy absolutely brand new clothes any more either.

"The cost has gone up everywhere."

O'Meara was one of about 1300 people who used the services of Tamaki Budgeting. Manager Alison de Marco said mortgage holders were doing it tough.

"You just think, 1 percent on home interest rates for a first-home buyer who's put everything that they could into owning their own home and suddenly they're confronted with an increase in interest rates, insurance, rating hikes, food prices, petrol.

"For some of them that's maybe five hours extra work a week."

The service used to see people wanting to save for a mortgage - now demographics were different, she said.

"We see 400 more clients than we did before Covid, but the difference is the more clients that we have that are working poor.

"These are the people that are actually working. They're not beneficiaries. They're the ones now that are struggling."

For people going about their day in Glen Innes, the struggle was real. Vao Fineanganofo used the budgeting service, and recommended it to others.

Over summer she grew her own food. She saved seeds and cuttings to regenerate her garden. She did not take out loans and would pay for only what she could afford from her wages.

"Where I cut my stuff is with food. There's a lot of people throwing food out... I only buy stuff if I need it. That's how I live my life and I don't have debts to pay."

Mokoare Isaaka and his family were cutting back on meat and vegetables for cheaper food, such as noodles. He worked as a cleaner, but felt his wages did not go as far as they used to.

"Three or four years ago was the best. Now it's worse. I see a lot of people struggling, but it's just the way you organise your budget.

"If you don't do those kind of things you go nowhere."

Michelle Elliott, a mother of three, said it felt like the cost of everything was rising.

"The only thing you can do is watch where you buy things, don't spend as much on the nice things any more. I don't get snacks and things for the boys. There's not much else to do really."

Whatever the situation, de Marco said the best time for anyone to sort their finances was now.