Mediawatch: Could a 'mortgage bomb' blow up borrowers?

Recent reports have warned of a 'mortgage bomb' that could blow up - and a growing number of people unable to pay back debts. Is the story as explosive as some headlines would have you believe?

"Could you find an extra $1600 a month in the household budget if you had to?" Lisa Owen asked Checkpoint listeners on RNZ National last Monday.

"That is the sharp end of the cost of living crisis for some Aucklanders - and that's on mortgage payments alone," she said, citing new numbers from Westpac.

Many mortgages were fixed for two years in 2020 and 2021 at interest rates roughly half those on offer now - and when house prices were surging. What Lisa Owen dubbed 'The Great Refixing' could mean eye-watering leaps in monthly repayments - and not only for Aucklanders.

This week, Newsroom reported a new survey saying 3 percent of mortgage-holders "could be facing the very real possibility of being forced to sell a property over the next year", according to the latest banking survey of just under 1100 people by research firm Horizon.

That would mean about 42,000 home loans were in trouble, according to Newstalk ZB.

BusinessDesk reported 70 percent of the same survey's respondents said they were "concerned they may not be able to afford payments" when they renew mortgages at current or higher rates.

In June, National Party deputy leader and finance spokesperson Nicola Willis kicked off the party's annual conference warning of a looming "mortgage bomb".

"The whole economy will shudder if it goes off," she said.

In her column in Wellington's daily The Post last weekend, former National Party press secretary Janet Wilson called it "mortgage Armageddon" with "steadily increasing numbers of people in arrears".

But how many?

"When you apply for a mortgage at those very low rates on offer through the pandemic, chances are you would have been tested at rates that are closer to where we're at now," Westpac's Satish Ranchhod told Checkpoint this week.

"The economy's in good shape ... and people have still got some buffers that are helping insulate them from that pain that's coming through from mortgages, as well as other living costs," he said.

"There's definitely more signs of stress but it is definitely not unmanageable," ANZ Bank chief executive Antonia Watson told Newstalk ZB earlier this month.

"We've always tested people on higher rates. So when you were down at 2 percent, we were testing at 5.8 percent. We now test at 8.75 percent so we make sure you can pay an amount higher than the national interest rate," she said.

"People are getting pay rises. Over Covid, we saw both businesses and personal customers really tighten their belts, improve their savings habits and paid down debts. Thirty five-odd percent of our home loans are more than six months ahead on their repayments."

When she was asked about mortgagee sales in April, Watson told interest.co.nz: "They're so much a last resort. I wouldn't even want to talk about them at the moment."

At that point, there were 38 properties advertised as residential mortgagee sales nationwide. Back in 2009 in the wake of the global financial crisis, there were more than 3000 mortgagee sales.

Interest.co.nz said the proportion of home loans in arrears on the first of May was lower than the 1.5 percent recorded at the start of March 2021.

It is in the interest of the banks to play down the danger of defaults and talk up the interventions that they have for people who might find they cannot keep up with payments.

In mid-May, interest.co.nz also pointed out a quarter of loans which were stressed tested by the banks in 2020 and 2021 are now above those stress testing limits.

So if things get worse as people's payments rise from now on, how many people might be casualties of a so-called mortgage bomb in the months ahead?

Depends which report you read.

Back in May, a Nicola Willis statement said 430,000 Kiwis were behind on debt repayments - including mortgages as well as car loans and credit cards - and the number had increased eight months in a row.

She cited new monthly data for March from credit reporting agency Centrix.

"Unless there's a circuit breaker of some sort, then we'd expect the trend to continue," Centrix managing director Keith McLaughlin told RNZ at the time.

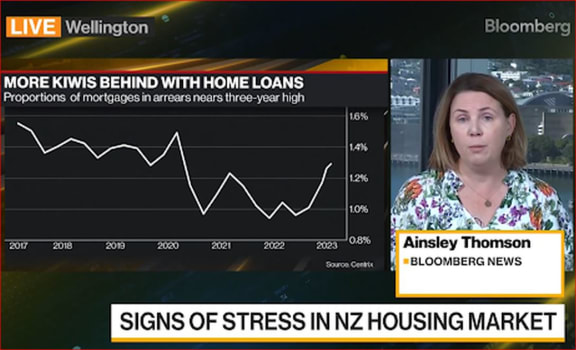

Shortly before that, global news agency Bloomberg reported "Missed mortgage payments swell in housing Bellwether New Zealand", and its New Zealand correspondent Ainsley Thomas also cited the Centrix data.

"In the last seven months, we've seen quite a marked change in that and a real uptick in people who are falling behind in their mortgage payments," she said.

Westpac told Bloomberg they'd seen an uptick in customers seeking financial support, but it said most of that was due to Cyclone Gabrielle in February. Kiwibank said it hadn't seen a significant uplift in consumers requiring support.

Centrix data for April found people behind in their payments had in fact fallen to 411,000.

"The drop is encouraging and suggests households are adjusting their borrowing and spending," Keith McLaughlin of Centrix told RNZ in early June.

Last week, Stuff ran the numbers under the headline "The mortgage refixing bomb".

Senior business journalist Miriam Bell reported that a third of New Zealand households have a mortgage and about a quarter of current lending originated in 2021 - and half of the mortgages are due for refinancing over the next 12 months.

But not so many will be coming off super low rates onto much higher rates all at once.

About 10 percent of mortgages are on floating rates, and ASB told Stuff a significant number of customers had already re-fixed on to higher rates over the past 18 months.

Other banks told Stuff they don't know what share of the mortgages are due to re-fix within the next month or 11 months from now, by which time the rates might possibly have eased.

BNZ said that less than half of 1 percent of its mortgages were in arrears for 90 days or more - far lower than the average of 1.9 percent in arrears back in March 2020.

Bernard Hickey in his newsletter, The Kaka, said talk of a mortgage bomb was "reckless".

He said the Horizon survey was an opt-in one and the responses didn't match reality - and Centrix stats showing nearly $5 billion worth of mortgages overdue was "way out of line with the official figures".

"We're not seeing a huge number of properties being put on the market which is what you'd expect if there was going to be a whole bunch of forced sales," he said.

Noting the incomes were rising and that banks had been careful not to lend to those unlikely to be able to afford increased payments, Hickey said those most likely to be in a difficult position now would be those who took risks to buy properties which they did not currently live in.

"They are effectively ... complaining about a government policy which made that investment choice riskier. That would be like saying the government should help out or bail out people who borrowed money to buy shares," he said.

Property was seen differently by politicians, Hickey said.

As if to make the point, the prime minister ruled out a Capital Gains Tax last Wednesday.

That won't dissuade people from putting their money into houses in future - possibly boosting the size of the mortgages people are prepared to take on, even at the risk of higher repayments making them even more unaffordable.